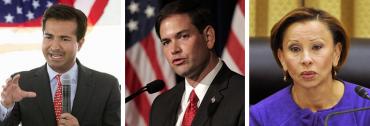

U.S. Sen. Marco Rubio, R-Fla., continued his focus on Puerto Rico this week, teaming up with U.S. Rep. Carlos Curbelo, R-Fla., and U.S. Rep. Nydia Velázquez, D-NY, to unveil a proposal giving that island and other American territories relief from a health-care tax.

The three legislators showcased the “Territory Health Insurance Tax Relief Act of 2017” on Tuesday. Under former President Barack Obama’s federal health-care law, health insurance providers were hit with annual fees, including ones in the territories where residents don’t have access to the marketplaces set up under that law.

The three legislators made the case that territory residents should not be forced to pay for something they do no have access to.

Rubio, who sits on the Congressional Task Force on Economic Growth in Puerto Rico, continued his efforts against Obama‘s health-care law, saying it did not work in the states or territories.

“Obamacare doesn’t only harm the pocketbooks of Americans on the mainland; it hurts Americans in Puerto Rico as well,” Rubio said. “The liberal bureaucrats who wrote and passed this disastrous law were blind to the needs of the island and instituted a health insurance tax that raises premiums for millions of consumers.

“It is unfair to Puerto Ricans to have to pay this Obamacare tax and endure higher premiums, only to be excluded from participating in the same health system that the rest of the United States does,” Rubio added. “As we work on the larger goal of repealing and replacing Obamacare, this legislation would repeal the law’s costly and unfair tax on Puerto Rico and help begin the process of revitalizing the health care system on the island.”

“Most of the Affordable Care Act doesn’t impact the territories, but the Health Insurance Tax is one of a small number of provisions that does, and it’s hurting families in our U.S. territories who are trying to get ahead,” Curbelo said. “These residents are subject to the burdens of the Affordable Care Act, but they do not have access to the benefits. We must provide relief to those who are incorrectly exposed to this burdensome tax.”

“Americans living in Puerto Rico and other U.S. territories are paying tax on a benefit they do not receive” Velázquez said. “This legislation would take the long overdue step of correcting this imparity and relieve a tax burden for residents of the Commonwealth who are already struggling in the face of severe economic difficulty.”

This marks the second piece of legislation Rubio sponsored this year focusing on Puerto Rico. After winning a second term in the U.S. Senate in November, Rubio introduced the “Economic Mobility for Productive Livelihoods and Expanding Opportunity (EMPLEO) Act” in December and brought it back in January. Rubio’s proposal would lower the employer covered minimum wage to $5 an hour, cutting expenses for businesses, while relying on a federal wage subsidy of up to $2.50 an hour for employees who make less than $10 an hour.